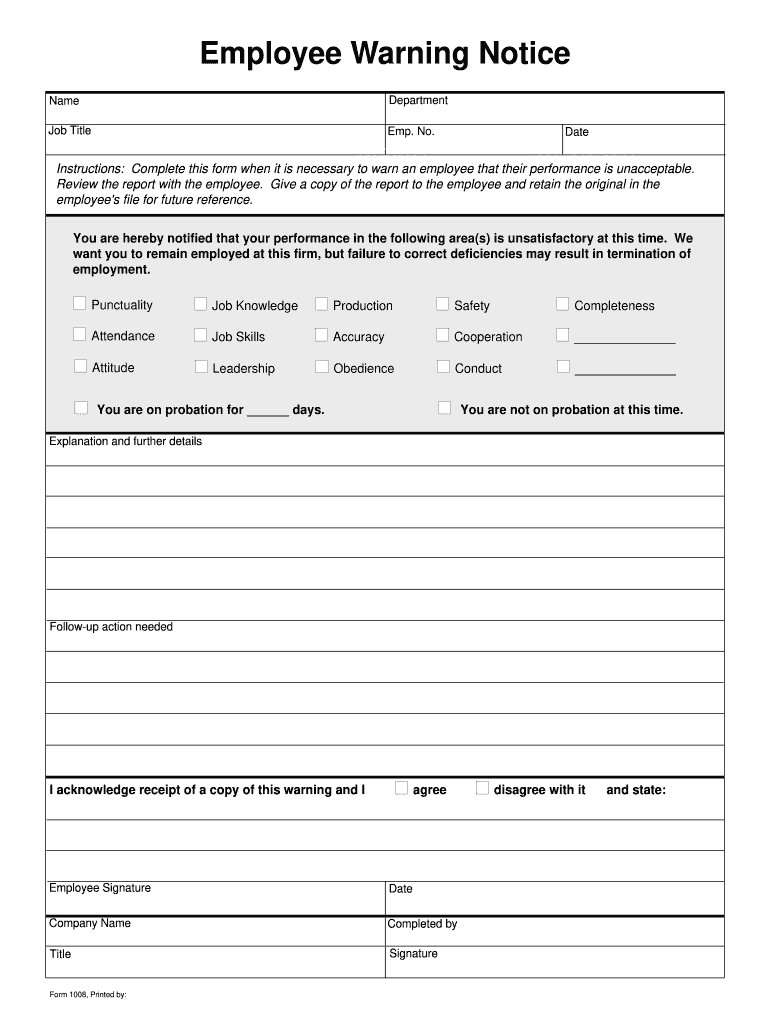

Who needs an Employee Warning Notice?

This form can be completed and directed by any employer when it is necessary to warn an employee that their performance is unacceptable.

What is the Employee Warning Notice for?

This Notice should be reviewed with the employee. The copy of the report should be given to the employee and the original should be retained in the employee’s file for future reference.

This form can notify the employee about unsatisfactory performance in the following areas: punctuality, job knowledge, production, safety, completeness, attendance, job skills, accuracy, cooperation, attitude, leadership, obedience, conduct.

By means of this form, the employee can be put on probation for specific amount of days.

Also, all the explanations and details concerning the notice and the performance can be given on this form as well.

Is the Employee Warning Notice accompanied by other forms?

There is no need to accompany this Employee Warning Notice by any other documents. It can be served to the employee as it is.

How do I fill out the Employee Warning Notice?

The following information should be provided in order to complete the form:

-

Name, department, job title of the employee;

-

Indication of the noticed area of performance;

-

Explanation and further details;

-

Follow-up actions that needed;

-

Acknowledgement of the receipt (should be filled by the employee);

Once completed, this form must be signed by the employee. Company name, title, and the name of the person who completed the form should be indicated as well.

Where do I send the Employee Warning Notice?

The original of this document must be attached to the employee?personnel file. A copy should be directed to the employee.